Silver, Platinum, Copper: The Great Return of Metals?

Published on July 23, 2025 at 12:28 am | By

Source: GoldBroker.com

Summary: This article explores the latest developments in the gold market. It covers important price changes, global events influencing gold demand, and expert opinions. Stay informed and see how this might affect your investment decisions in Malaysia and globally.

While gold has been the big winner in recent years, many other metals are now becoming increasingly scarce. Rising demand for metals is mainly driven by the energy transition (electric vehicles, photovoltaic panels), electronics, data centers, artificial intelligence and communications networks.

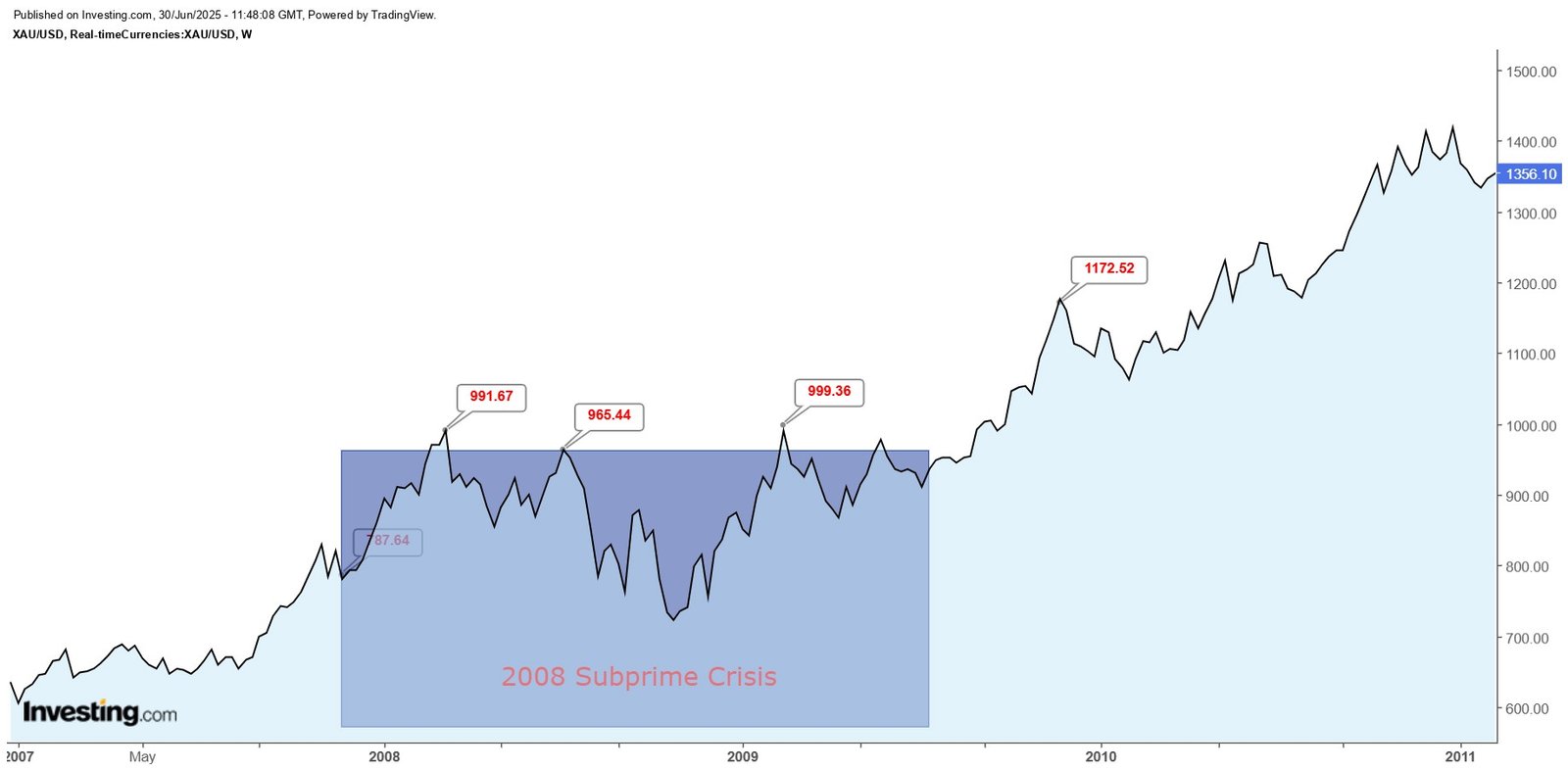

At the same time, the growing difficulties associated with mining production, whether due to geopolitical, environmental or technical constraints, are fuelling a structural deficit between supply and demand, exerting sustained upward pressure on prices. Over the past five years, silver, platinum and copper prices have risen by +110%, +26% and +70% respectively.

These performances have common causes: growing industrial needs and production that is struggling to keep pace. Growing demand for these metals is thus leading to a structural readjustment of the market. Let’s take a look at the fundamentals of a market under pressure, and the outlook for the coming years.

Increasi…

📊 Market Context & Insight

The current gold trends are being shaped by factors such as inflation, central bank moves, USD strength, and geopolitical tensions. Understanding how these forces interact can help investors make informed decisions.

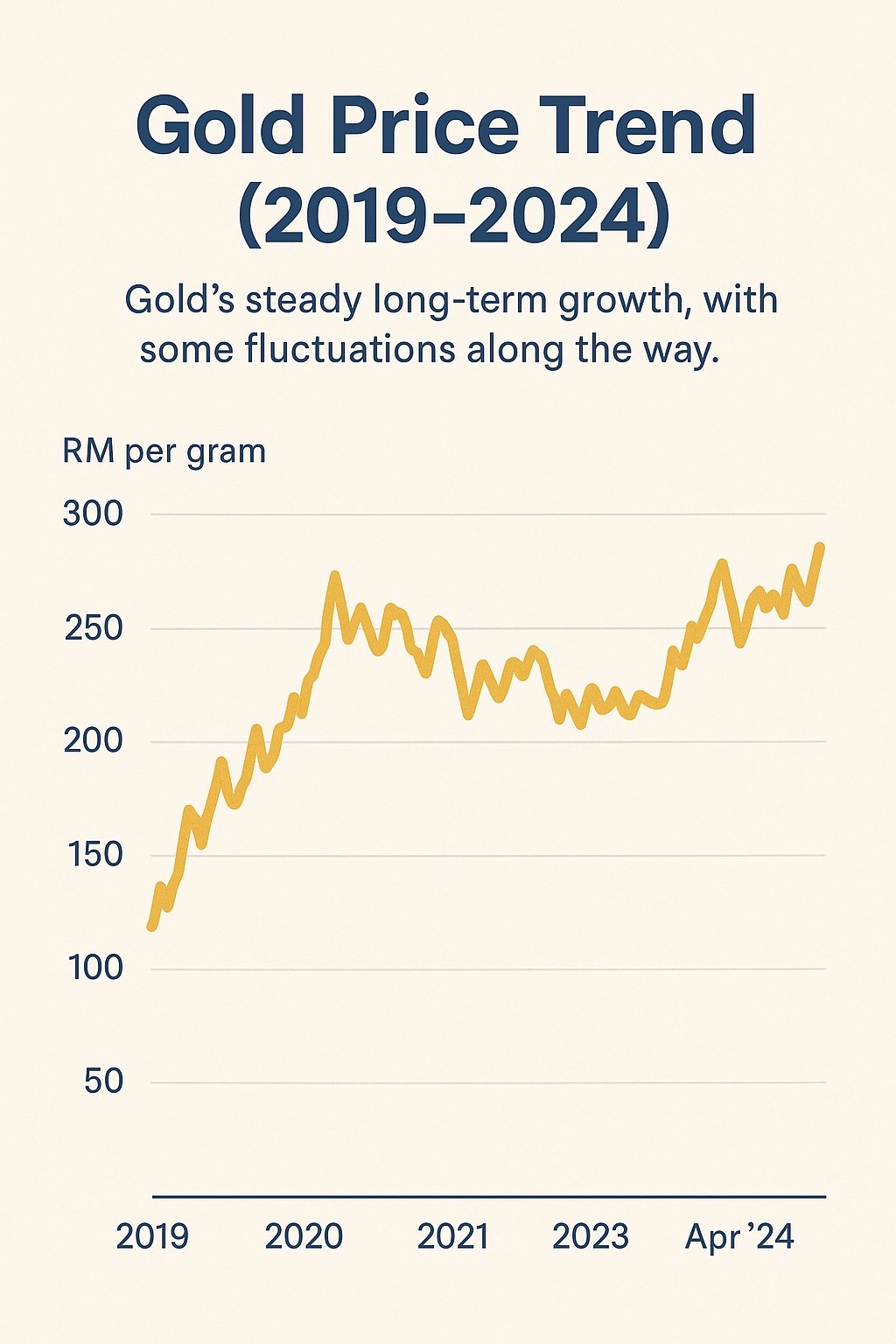

💡 What This Means for Malaysian Investors

As a Malaysian investor, gold remains a strategic hedge against currency depreciation and economic uncertainty. Consider platforms like Public Gold or Maybank GSA to start building your gold portfolio.

🔗 Useful Resources

Original Article: Silver, Platinum, Copper: The Great Return of Metals? from GoldBroker.com

Note: This article was auto-fetched from trusted news sources. For educational purposes only. Please verify with official sources before making financial decisions.

0 comments