The Value of Gold in Today's Market

Gold has always been known as a reliable asset, particularly during uncertain economic times.

Many investors turn to gold as a safe haven, allowing them to preserve their wealth.

With as little as RM100, you can begin to tap into the potential of investing in gold, diversifying your portfolio and safeguarding your financial future.

Starting Your Gold Investment Journey

There are various avenues through which you can invest in gold, such as gold coins, bars, and even digital gold platforms.

These options allow you to enter the market without needing large sums of money, making it possible for anyone to invest in gold.

Why Save in Gold?

In uncertain economic times, gold is a safe-haven asset.

It protects your wealth from inflation, currency devaluation, and market volatility.

Firstly, gold often holds its value over time, providing a hedge against inflation and currency fluctuations.

Historically, gold has had a positive return on investment, making it a wise choice for long-term financial strategy.

Benefits of Monthly Gold Savings

1. Low Commitment, High Discipline

RM100/month is affordable and consistent — the key to compounding wealth.

2. Hedge Against Inflation

Gold retains its value over time, unlike cash that loses purchasing power.

3. Liquidity

Easily convert your gold into cash anytime — online or offline.

4. Tangible Asset

You own a real physical asset, not just numbers on a screen.

Reputable online platforms in Malaysia

Platform | Product Type | Start From | Storage/Delivery |

|---|---|---|---|

Bars & coins (e.g. PAMP) | ~1g | Vault or delivery | |

Bars, coins | Live market pricing | Delivery or vault | |

Bars, coins | Market-based pricing | Vault & delivery | |

Physical & digital metals | Live quotes | Vault or self-pickup | |

Physical gold | Live FX + spot | Vault or self-keeping | |

Bars, coins, jewelry | Varies | Store pickup / delivery | |

Maybank / Bank Islam / UOB | Digital → redeemable physical | 1g/min RM10 | Redeem at branches or by courier |

Digital gold, redeemable | RM10 | Redeemable to bars or coins |

Digital Gold Investment Platforms in Malaysia

Platform | Platform Type | Min. Investment | Physical Delivery | Shariah-Compliant? | Key Features |

|---|---|---|---|---|---|

Hybrid Digital-Physical | RM10 | Yes (≥4.25g) | ✅ Yes | LBMA-backed, wallet feature, redeem bars/coins, Islamic finance-friendly | |

Digital-only | RM10 | ❌ No | ❌ No | Real-time pricing, CIMB liquidity, no redemption, convenient mobile access | |

Hybrid Digital-Physical | RM10 | ✅ Yes | ✅ Yes | LBMA-certified, insured, full trading hours, physical redemption available | |

Hybrid Digital-Physical | RM50 | ✅ Yes (≥50g) | ❓ Not stated | Low storage fee (RM0.05/day), fractional gold savings, physical redemption | |

Hybrid Digital-Physical | RM10 | ✅ Yes | ✅ Yes | LBMA 999.9 gold, redeem in dinar/gram, daily insured storage | |

Robo-advisor | RM100 (est.) | ❌ No | ✅ Yes | Diversified portfolio including gold, Shariah-compliant robo-advisor | |

~RM300–400 | ❌ No | ✅ Yes | Diversified portfolio including gold, Shariah-compliant robo-advisor |

Summary Recommendation:

| If you want to... | Consider These Platforms |

|---|---|

| ✅ Redeem physical gold | BGD, eMas KT, Mercury MBS, KGOLD |

| ✅ Shariah-compliant investment | BGD, eMas KT, KGOLD, Wahed, TradePlus ETF |

| ✅ Start with low capital (≤ RM10) | BGD, TNG eMas, eMas KT, KGOLD |

| ✅ Trade gold like a stock | TradePlus Shariah Gold Tracker (0828EA) |

| ✅ Invest in gold + diversified assets | Wahed Invest |

Physical Gold & Jewellery Stores in Malaysia

Store Name | Gold Type Offered | Gold Purity | Bar/Coin Sizes | Physical Locations | Key Features |

|---|---|---|---|---|---|

Bullion bars, coins, jewellery | 999.9 (24K) | 2g, 5g, 10g, 20g | Major malls (nationwide) | Premium design, trusted brand | |

“Bunga Raya” bars, jewellery | 999.9 (24K) | 20g+ | Nationwide | Well-known brand, long history | |

Jewellery, some bullion bars | 999.9 (24K) | Varies (not listed) | Major malls (Mid Valley, etc.) | Elegant designs, gift-friendly packaging | |

Bullion bars & coins | 999.9 (24K) | 1g to 1kg | KL & Melaka | Real-time pricing, competitive rates | |

Bullion bars, coins, jewellery | 999.9 (24K) | Common weights | Melaka (Dataran Pahlawan) | Certified gold, offers buyback service | |

Bullion bars & dinar coins | 999.9 (24K) | 2.5g to 20g | Penang & online | Dinar coins, Shariah-friendly design | |

Bullion bars, coins (wide range) | 999.9 (24K) | 0.5g to 1kg | KL, Ipoh, Kuching + online | Strong buy/sell network, LBMA suppliers |

Recommendation:

| If You’re Looking For... | Best Options |

|---|---|

| ✅ Small to medium bullion (2g–20g) | Wah Chan, Masdora, Poh Kong |

| ✅ Large-size gold bars (100g–1kg) | Kim Heng, Public Gold |

| ✅ Jewellery with investment value | Tomei, Wah Chan, Mustafa |

| ✅ Buyback and resale support | Public Gold, Mustafa, Kim Heng |

| ✅ Online + offline convenience | Public Gold, Masdora |

| ✅ Dinar (Islamic coin) collectors | Masdora, Public Gold |

Unit Trust Gold Funds

Platform | Type | Min. Investment | Shariah Compliance | Physical Gold Backing |

|---|---|---|---|---|

Unit Trust Fund | - | No | Yes (via Pictet) | |

Unit Trust Fund | RM 5,000 | Yes | Yes (funds/ETFs) | |

Exchange‑Traded Fund | 100 units (~RM 300–400) | Yes | Yes (≥95%) | |

Digital Platform | RM 100 | Yes | Yes (via fund) |

Recommendations:

1. For Shariah‑compliant & long‑term saving:

→ MiGOLD or TradePlus Gold ETF.

2. For active trading or portfolio flexibility:

→ TradePlus Gold ETF via brokerage platform.

3. For micro‑investments via app:

→ Versa offers simplicity and low cost.

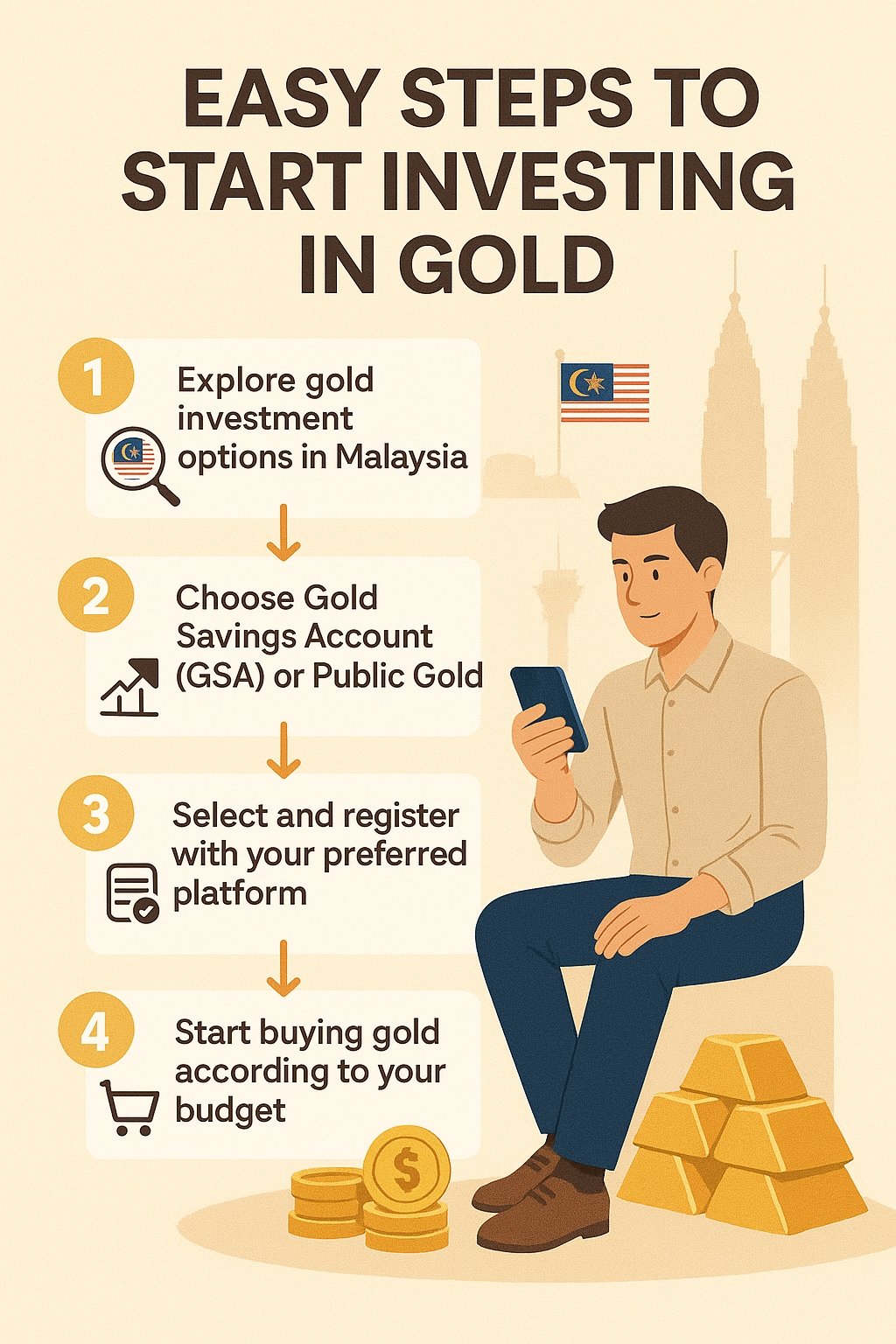

Easy Steps to Start Investing in Gold

Step 1: Choose a Trusted Platform

Select a reliable and transparent gold provider, and make sure they offer:

- Certified 999.9 fine gold (24K)

- Low spread (buy/sell price gap)

- Physical delivery or storage options

- Easy monthly purchase setup

Step 2: Set Your Monthly Budget

RM100/month is a good starting point.

You can buy:

- Fractional gold grams (e.g. 0.5g, 1g)

- Digital gold with future redemption

- Gold bars/small wafers with saving options

✅ Tip: Use auto-debit or scheduled reminders to stay disciplined.

Step 3: Track Gold Prices Weekly

Keep an eye on the market using:

- goldprice.org live pricing

- Apps like Gold Price Live, or

- Google “Harga Emas Semasa”

Buy when prices dip — or set a fixed date every month (Dollar Cost Averaging).

Step 4: Store It Safely

Options:

- Keep small amounts at home in a secure place

- Use certified vaulting/storage services

- Redeem physical gold when ready

Step 5: Review Every 6–12 Months

- Recalculate your savings progress

- Increase your monthly amount if possible

- Plan for medium-term goals (e.g., Umrah, car downpayment, children’s education)

🧮 Example: How Your Gold Grows (Estimation)

Year | Monthly Saving | Total Saved | Approx Gold (gram) |

|---|---|---|---|

1 | RM100 x 12 | RM1,200 | ~2.4g – 2.45g |

3 | RM100 x 36 | RM3,600 | ~7.2g – 7.35g |

5 | RM100 x 60 | RM6,000 | ~12.0g – 12.25g |

(Based on average gold price RM490–RM500/gram) Give it a try using our free tools.

🔎 Interested in learning more? Explore our gold guides and insights:

→ Investing in Gold: How RM100 Can Secure Your Future

→ How to Build Passive Income with Gold in Malaysia (From RM100/month)

→ Understand the Gold Cycle in Malaysia – When to Buy, Hold, or Sell Smartly

→ Diversify Your Gold Portfolio – Tips for Smarter Gold Investing

🎯 Start Today: One Gram at a Time

The earlier you start, the more gold you accumulate.

The more consistent you are, the faster your wealth grows.

Don’t wait to have thousands. Start with RM100.

👉 Visit EmasGold.com.my to start your savings journey.

0 comments