Why Understanding the Gold Cycle Matters?

Gold has long been seen as a safe haven and a reliable store of value, especially during uncertain times.

But to truly build wealth through gold, Malaysians need more than just basic "buy low, sell high" advice.

Understanding how the gold cycle works — including price trends, inflation patterns, and market behavior — is essential for making smarter investment decisions.

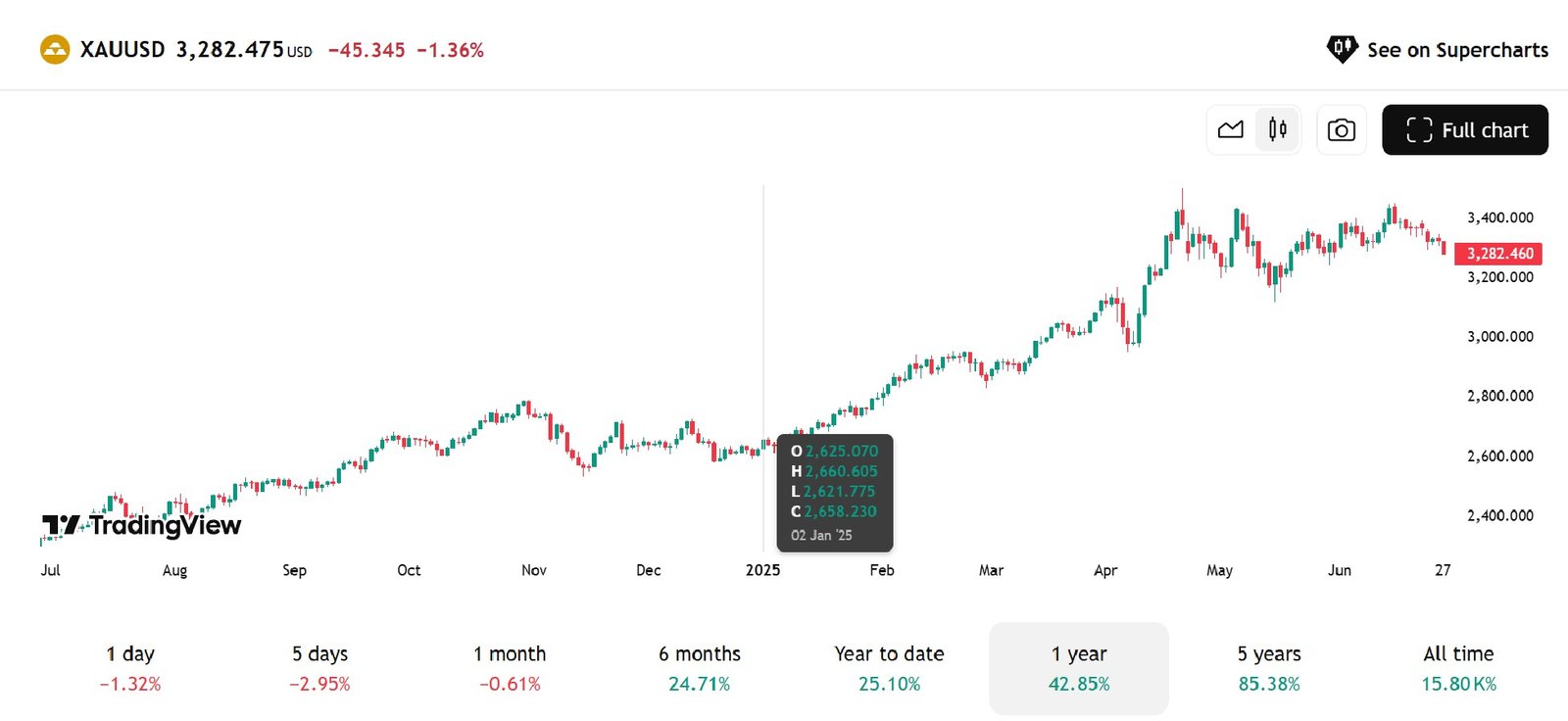

Since opening at $2,625.07 on January 2, 2025, gold has surged significantly, reaching a closing price of $3,327.82 by June 26, 2025. Screenshot from Tradingview

Malaysia Gold Market Overview (2025)

The gold investment landscape in Malaysia is evolving quickly.

From Gen Z savers using digital apps like HelloGold to older generations purchasing gold bars from Public Gold, interest is growing across age groups.

As of mid-2025:

- Gold trades around RM340 per gram, though prices fluctuate daily.

- Physical gold demand remains strong due to inflation concerns.

- More investors are adopting digital platforms like MAE, HelloGold, and PG GAP.

- Shariah-compliant gold options are widely preferred.

- Gold ETFs such as TradePlus Shariah Gold Tracker (0828EA) on Bursa Malaysia are becoming increasingly popular among traders.

The Ringgit was exchanged at a rate of 4.4515 per USD on December 19, 2024. Since then, it has strengthened, closing at 4.2260 per USD on June 26, 2025. Screenshot from Tradingview

1. What Drives Gold Prices in Malaysia?

Gold prices are shaped by both global and local economic forces.

Key drivers include:

- USD/MYR Exchange Rate – A weaker Ringgit causes gold prices in Malaysia to rise.

- Inflation – As the cost of living increases, more people turn to gold to preserve their purchasing power.

- Global Uncertainty – Crises like wars or pandemics tend to increase demand for gold.

- Interest Rates – When interest rates are high, gold loses some appeal as it doesn’t yield any income.

Screenshot from Google Trends

2. Trend & Demand Analysis (2023–2025)

Google search data shows that terms like “pelaburan emas” are reaching all-time highs in Malaysia, especially during periods of financial instability or rising inflation.

Gold demand is being driven by:

- Rising cost of living (CPI up 3.1% year-over-year)

- Increased financial literacy and awareness of Islamic finance

- Growing concern over fiat currency devaluation

- Active discussions on platforms like Telegram, Facebook, and TikTok around gold savings and price alerts

3. Understanding the Gold Price Cycle

Gold tends to follow a predictable price cycle consisting of four key stages:

- Accumulation Phase – Prices are flat, interest is low, and smart investors quietly accumulate gold.

- Uptick – Prices start to rise gradually as early adopters buy in.

- Boom – Mainstream attention kicks in, prices surge, and the public jumps in.

- Correction – Prices dip due to panic selling or market overreactions.

Tip: The best time to invest is during the accumulation or early uptick phases — not when everyone is chasing hype.

4. Intermarket Analysis: How Gold Reacts to Other Assets

Gold doesn’t move in isolation. It reacts to trends in other markets:

Asset | Relationship to Gold | Example |

|---|---|---|

USD | Inverse | Stronger USD usually means lower gold |

Stock Market | Mixed (depends on sentiment) | Market crash → gold spikes |

Crypto | Competes as store of value | Bitcoin drop often aligns with gold rise |

Bonds | Inverse (due to yields) | Rising yields can reduce gold demand |

📊 For deeper insights, explore intermarket analysis and see how gold connects with stocks, bonds, and forex.

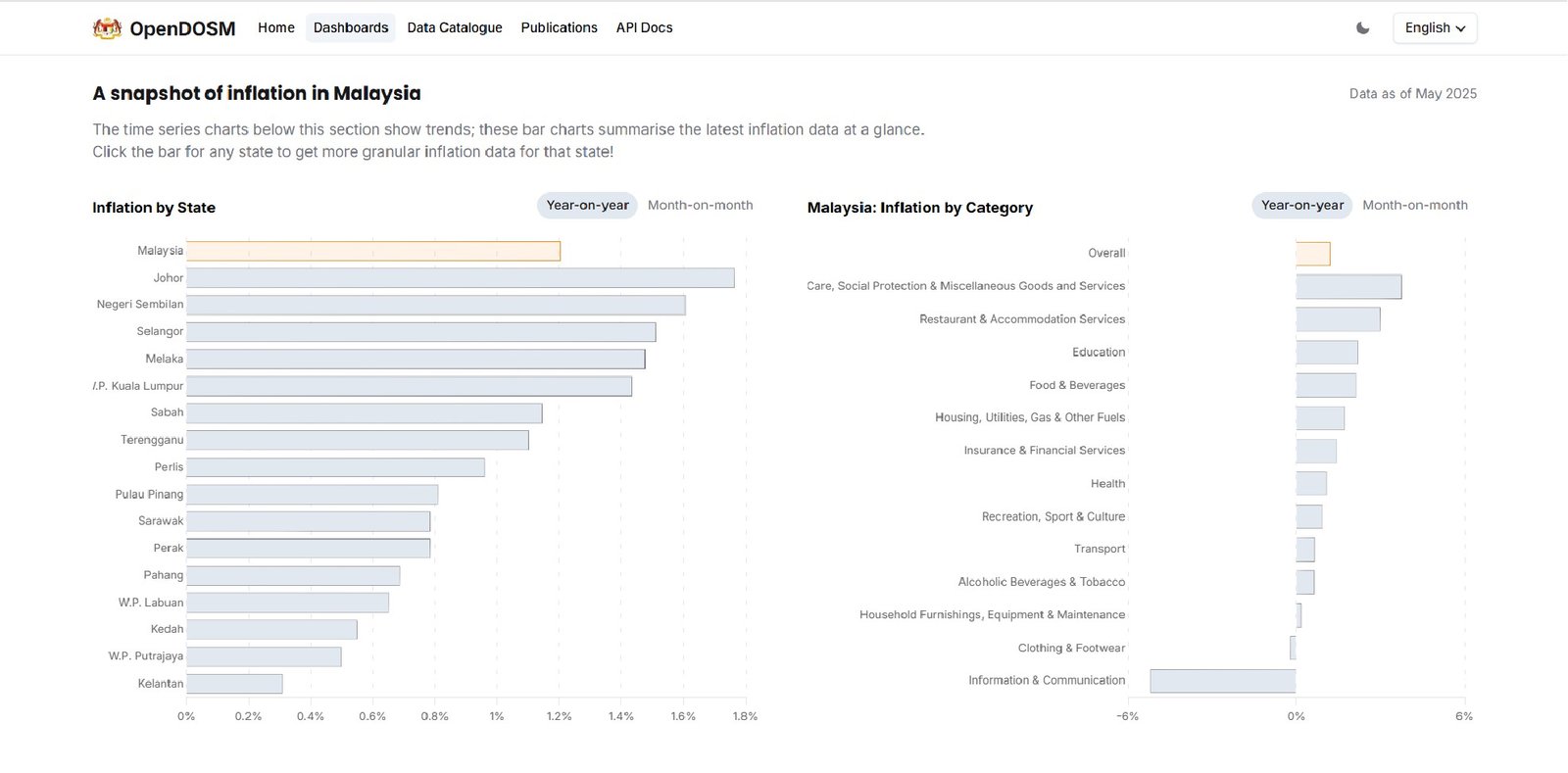

A snapshot of inflation in Malaysia. Screenshot from open dosm

5. Inflation & Gold: A Long-Term Hedge

Gold historically performs well in inflationary environments.

In Malaysia:

- Average CPI growth (2022–2025): 2.9%–3.3%

- Gold has outperformed property and cash savings during this period

- The Ringgit fell 7.2% against the USD from 2023 to 2024

- Gold prices have beaten inflation in 4 of the past 5 years

This makes gold one of the most effective tools for wealth preservation.

6. Investment Strategy: DCA Over Timing

Rather than waiting for a perfect buying opportunity, it’s better to invest consistently using Dollar Cost Averaging (DCA).

This approach reduces emotional decision-making and averages out your purchase cost over time.

Suggestions:

- Allocate RM100–RM500 per month

- Use platforms like GAP (Public Gold), HelloGold, or MGIA (Maybank Gold)

- Automate your purchases to stay disciplined

7. Tools to Track Harga Emas in Malaysia

To stay updated on gold prices and trends, use these tools:

- Public Gold App – Offers real-time prices and GAP saving features

- GoldPrice.org – Tracks global prices in various currencies

- Telegram – Search for “Harga Emas Malaysia” for daily updates

8. When to Sell (and When Not To)

Sell your gold only if:

- You’ve achieved your financial target

- You need emergency funds

- You’re rebalancing your overall portfolio

Avoid selling just because of a short-term price drop.

Gold is meant to be a long-term stabilizer in your financial plan, not a quick-profit asset.

🔎 Interested in learning more? Explore our gold guides and insights:

→ Investing in Gold: How RM100 Can Secure Your Future

→ How to Build Passive Income with Gold in Malaysia (From RM100/month)

→ Understand the Gold Cycle in Malaysia – When to Buy, Hold, or Sell Smartly

→ Diversify Your Gold Portfolio – Tips for Smarter Gold Investing

Conclusion: Gold is a Marathon, Not a Sprint

By understanding the gold cycle and broader market dynamics, you’ll be able to invest more confidently and sustainably.

Focus on smart entry points, regular contributions, and long-term holding. This disciplined approach turns gold from a simple asset into a powerful wealth-building tool.

Continue your gold investment journey:

- Start Small: Beginner Gold Investment Guide

- Build Passive Streams with Gold

- Diversify Your Gold Portfolio

0 comments