Investing in gold isn't just about tracking gold prices alone. Smart investors look at the bigger picture — how other markets move in relation to gold. This is known as intermarket analysis.

In this article, we’ll break down what intermarket analysis is, how it affects gold, and what indicators you should watch as a gold investor.

📘 What Is Intermarket Analysis?

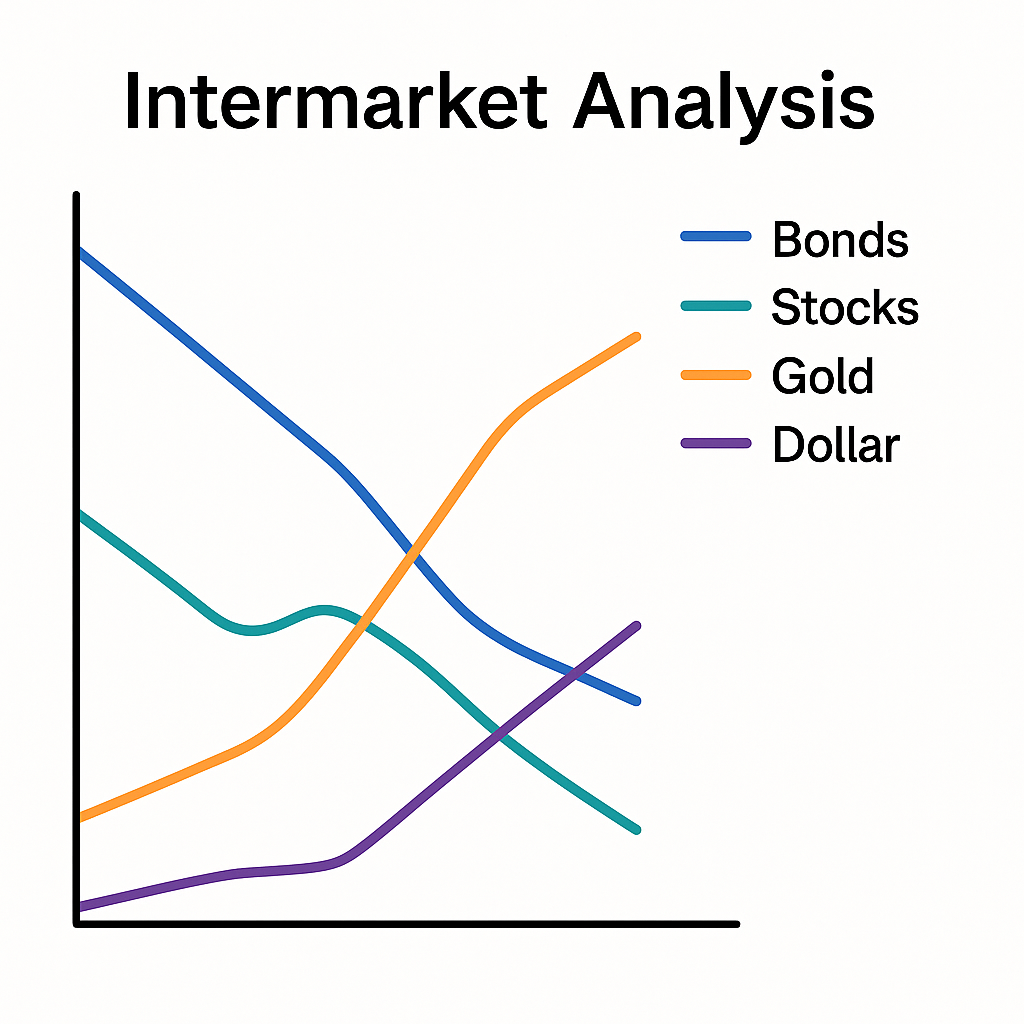

Intermarket analysis is a method of evaluating the relationships between different financial markets — such as stocks, bonds, currencies, and commodities — to better understand trends, risks, and investment opportunities.

Gold, being a globally traded asset, is heavily influenced by movements in other markets.

By studying these relationships, you can gain deeper insight into when to buy, hold, or sell.

🔗 Key Markets That Influence Gold Prices

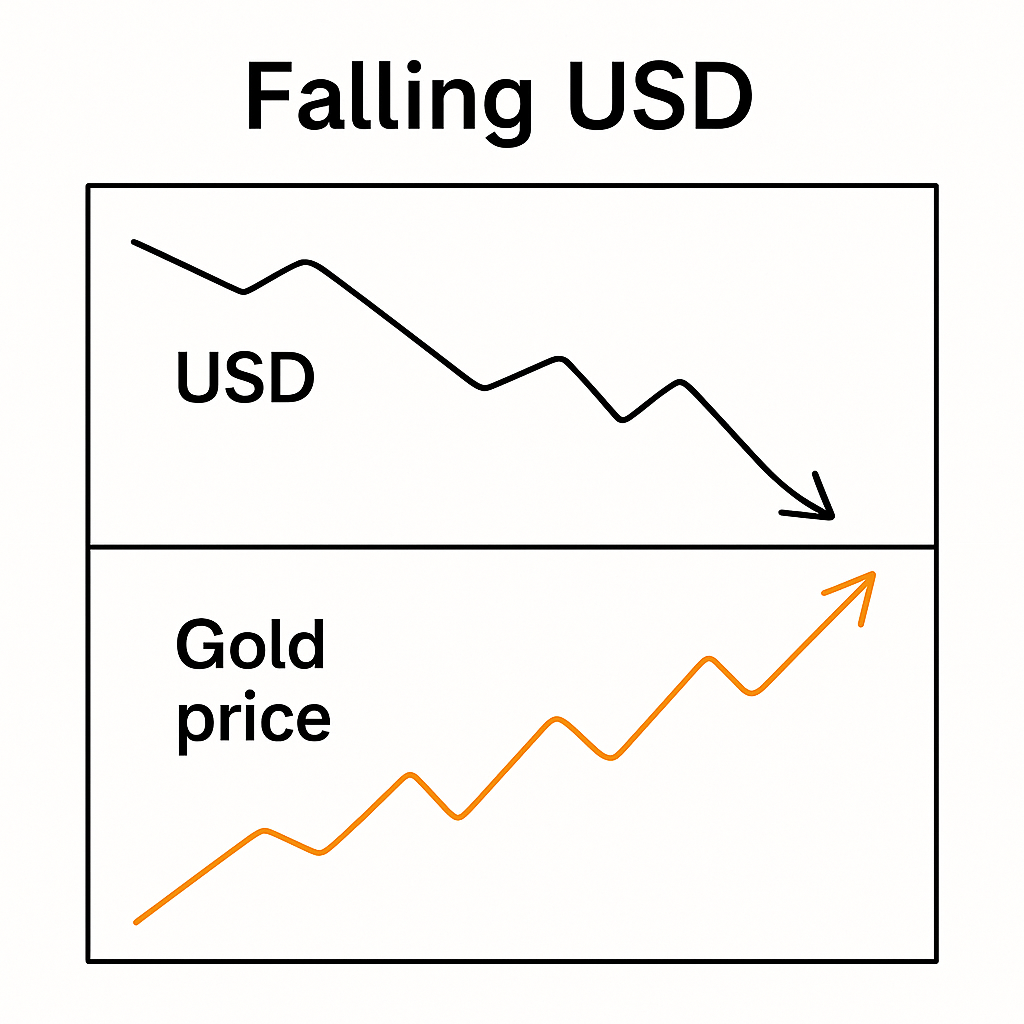

1. 🏦 US Dollar (USD)

- Gold and the US Dollar often move inversely.

- When the dollar strengthens, gold becomes more expensive in other currencies, reducing demand.

- When the dollar weakens, gold becomes more attractive, especially as a store of value.

📊 Watch for: S&P 500 Index

2. 📈 Stock Market (Equities)

- During times of stock market volatility or crashes, investors often move funds into gold as a safe haven.

- When markets are booming, demand for gold may fall as investors chase returns elsewhere.

📊 Watch for: US 10-Year Treasury Yield, Bursa Malaysia Index

3. 💰 Interest Rates (Bonds)

- Gold does not pay interest. So when interest rates rise, bonds become more attractive and gold may underperform.

- When real interest rates (interest rate minus inflation) are low or negative, gold tends to shine.

📊 Watch for: US 10-Year Treasury Yield, Brent Crude Oil Prices

4. 📂 Commodities (Oil)

- Rising oil prices can signal inflation, which often boosts gold demand as a hedge.

- However, too much inflation may cause interest rates to rise, putting pressure on gold.

📊 Watch for: Brent Crude Oil Prices

5. 🏦 Central Bank Policies

- Gold is influenced by monetary policy from institutions like the US Federal Reserve or Bank Negara Malaysia.

- Policies like quantitative easing or rate cuts often boost gold prices.

🪙 What Intermarket Patterns Tell Us About Gold?

| Condition | Likely Gold Impact |

|---|---|

| Falling USD | Gold price rises |

| Rising Inflation | Gold demand increases |

| Stock market crash | Gold becomes a safe haven |

| Rising interest rates | May pressure gold prices |

| Geopolitical tensions | Supports gold demand |

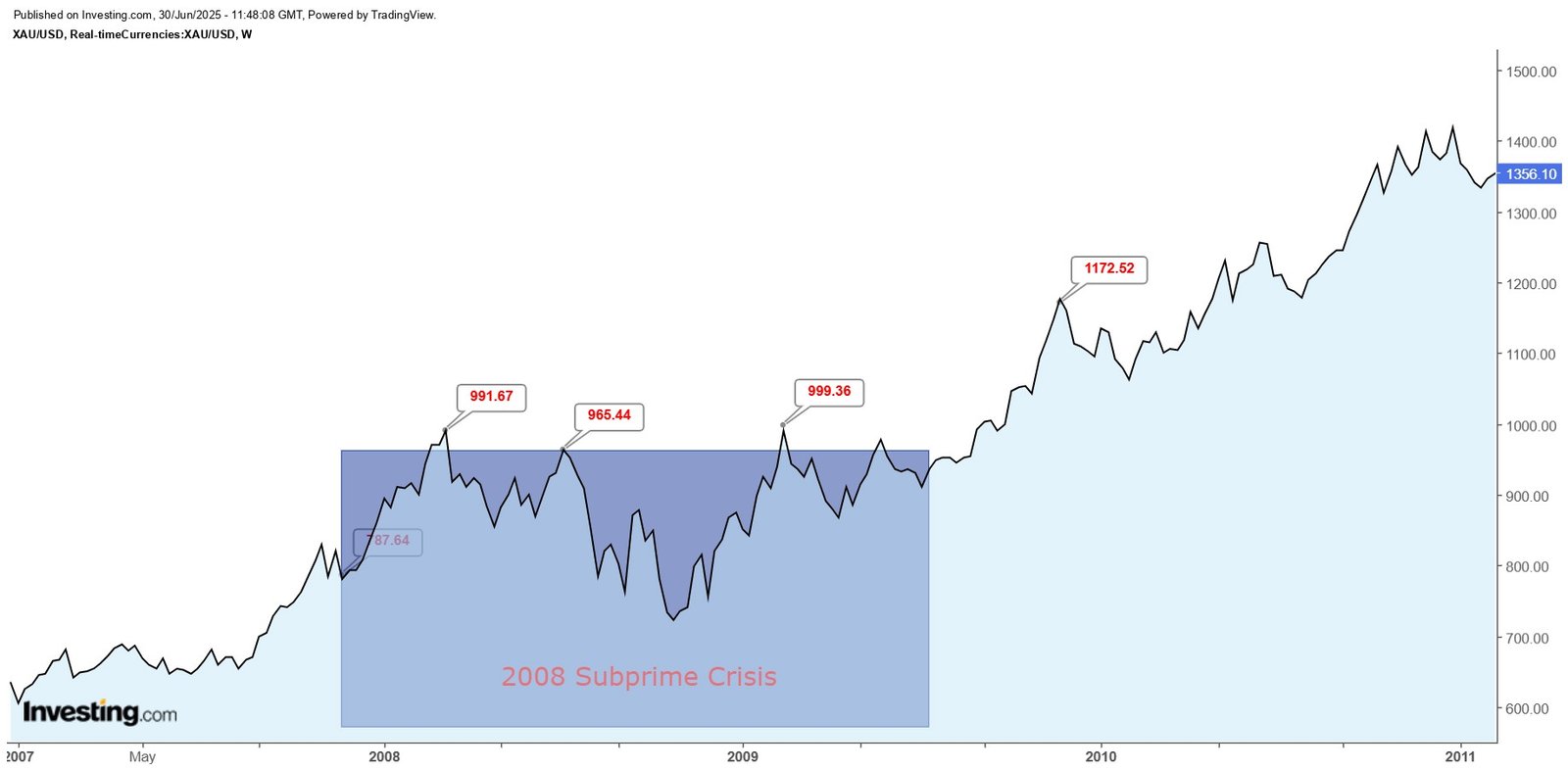

The Dow Jones plunged from over 14,000 to below 6,600 during the 2008 Subprime Crisis, marking one of the steepest market crashes in history.

During the 2008 financial crisis, while stock markets plunged, gold held its ground and even gained momentum, rising from below $700 in late 2007 to over $1,350 by 2011.

💡 Case Study: 2008 Global Financial Crisis

During the 2008 crisis, global stock markets crashed, central banks slashed interest rates, and investors fled to safe havens.

Gold surged from around USD 700 in 2007 to over USD 1,800 by 2011.

This event is a classic example of how:

- Falling stocks

- Weakening USD

- Stimulus policies ... all converged to send gold soaring.

🌐 Malaysia-Specific Indicators

Malaysian investors should also track:

- OPR (Overnight Policy Rate) by Bank Negara

- MYR/USD exchange rate (Ringgit strength)

- Local pricing differences from retailers like Public Gold, Poh Kong, and Wah Chan

🔍 These influence how international gold prices translate into local retail prices.

🔐 Gold vs Crypto: Safe Haven Debate

Both Bitcoin and gold are considered limited-supply assets. However:

- Gold has a proven historical record as a safe haven

- Crypto is more volatile and lacks correlation with traditional intermarkets

Some capital flows to Bitcoin may temporarily divert interest from gold, especially among younger investors.

📓 Glossary of Key Terms

Safe Haven: Asset investors buy during uncertainty (e.g., gold).

Inflation Hedge: Asset used to protect purchasing power from rising prices.

DXY: US Dollar Index — measures the USD's strength against other major currencies.

Real Interest Rate: Nominal interest rate minus inflation.

🛍️ Intermarket Signals Checklist

Here are 5 top signals every gold investor should monitor:

- ✅ US Dollar Index (DXY)

- ✅ US & Malaysia Interest Rates (e.g., OPR, Fed rate)

- ✅ Inflation Trends (CPI)

- ✅ Stock Market Health

- ✅ Central Bank Policy Statements

🚩 Final Thoughts

Gold does not move randomly. Its price is often the result of a complex dance between currencies, interest rates, market sentiment, and global risk.

Intermarket analysis gives you the map to understand that dance — and make better decisions.

Whether you're saving RM100 a month in gold or building a serious portfolio, mastering intermarket relationships can make you a more informed investor.

📩 Want more guides like this? Subscribe to EmasGold.com.my for weekly insights on gold investment and personal finance.

0 comments